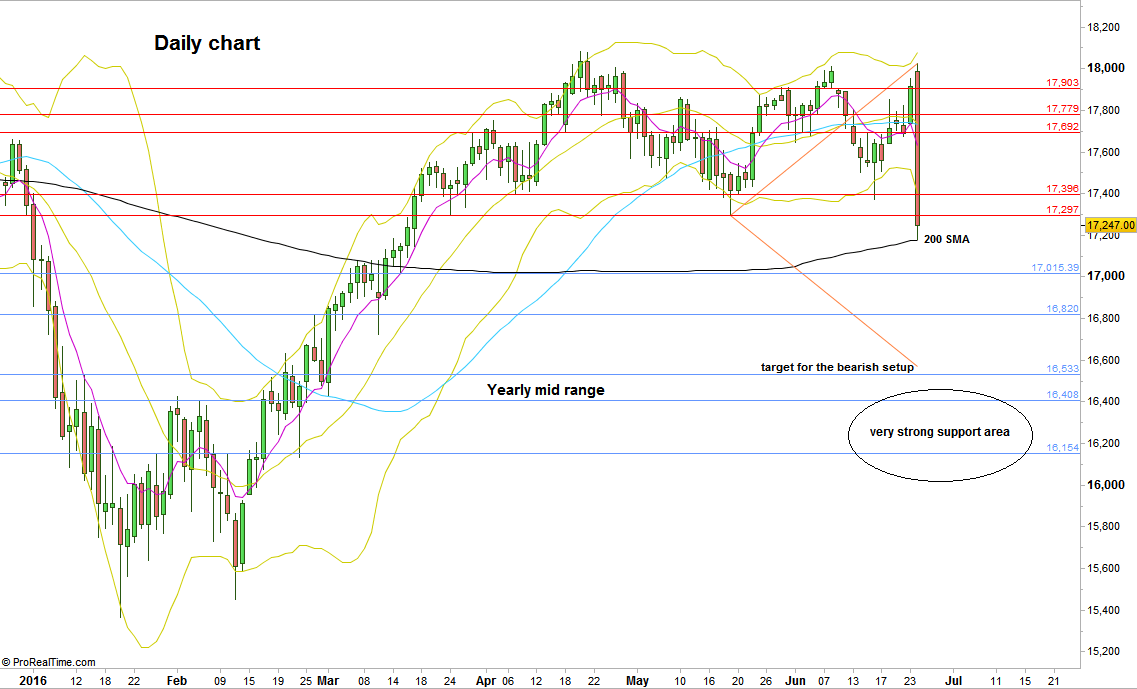

Learn more here and then try out a demo account (non-US residents only). To receive additional articles from Jeremy via email, join Jeremy’s distribution list.Įxperience no stop or limit trading restriction on US30 trades. See Jeremy’s recent articles at his Bio Page. Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU If for some reason prices break down below the February 11 low of 15,500, then the premise of this analysis is incorrect and we will look to assess other alternative patterns at play. If that fails, then yesterday’s low near 16,160 may act like a magnet to possibly provide the next level of support. If prices are resisted and fall, 16,300-16,400 might offer some support. However, we don’t know if prices will immediately continue higher or not. If the 16,663 level breaks, then price action around 16,831 will help clear up the near term pattern and we can begin to dial in targets for remainder of the move. The US30 has some congestion resistance between now and 16,663. That suggests we’ll likely see 17,000-17,350 over the coming days. We know from Elliott wave theory that a 5 wave move to begin a trend must be followed up with another 5 wave move of similar magnitude. That entire move is labeled as (a) on the chart above. Zooming into an intraday chart and implementing Elliott Wave technical analysis, we can see that the February 11 low to last week’s high appears to have carved out in 5 waves. Our assessment of the waves suggest that a case is being built to look for near term dips to be bought while targeting 17,000-17,350.

On a daily basis, this is a bullish candle formation that suggests additional gain are on the horizon.

The US30, a CFD which tracks the Dow Jones Industrial Average, finished yesterday on a high note after an initial sell off that pulled the index down to new weekly lows. Below 15,500 invalidates the near term bullish biasĭow futures traded a little higher overnight on the heels of a bullish reversal for the Dow Jones Industrial Average. Near term bullish traders may find support in the 16,300-16,400 zone market indices, after the Dow Jones Transportation Average.- Bullish hammer candle pattern on the daily chart yesterday suggests the near term trend is up The factor is changed whenever a constituent company undergoes a stock split so that the value of the index is unaffected by the stock split.įirst calculated on May 26, 1896, the index is the second-oldest among U.S. The value of the index can also be calculated as the sum of the stock prices of the companies included in the index, divided by a factor which is currently approximately 0.152. Furthermore, the DJIA does not use a weighted arithmetic mean. It is price-weighted, unlike stock indices which use market capitalization. The DJIA includes only 30 large companies. stock market compared to a broader market index such as the S&P 500. Many professionals consider it to be an inadequate representation of the overall U.S. The DJIA is one of the oldest and most commonly followed equity indices. The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States.

0 kommentar(er)

0 kommentar(er)